💸 Invest at your own risk.

📊 Past performance does not guarantee future results.

📜 Always do your own research or consult a licensed financial advisor.

If you’ve been keeping an eye on the markets lately, you’ve probably seen the headlines: the gold price just smashed through $3,500 for the first time in history. This isn’t just another milestone—it’s a flashing neon sign that investors are scrambling for safety. And guess who’s at the center of this storm? Former President Donald Trump, whose latest broadsides against Federal Reserve Chair Jerome Powell have sent shockwaves through Wall Street. Let’s unpack what’s going on, why it matters, and what you need to know.

Why Gold? The Timeless Safe Haven

Gold has always been the “go-to” asset when uncertainty reigns. Unlike stocks or bonds, it doesn’t rely on corporate profits or government promises. It’s tangible, finite, and universally trusted. But hitting 3,500?That’s∗big∗.Toputthisinperspective,goldwastradingataround3,500?That’s∗big∗.Toputthisinperspective,goldwastradingataround1,800 just three years ago. The recent spike reflects a perfect storm of geopolitical tensions, inflation fears, and, yes, political drama.

Take 2008, for example. During the financial crisis, gold surged 25% as banks collapsed. Fast-forward to 2020: the pandemic drove prices up another 30%. But today’s rally is different. This time, it’s not just about external crises—it’s about a direct attack on the institutions meant to stabilize the economy.

Trump vs. Powell: A History of Tension

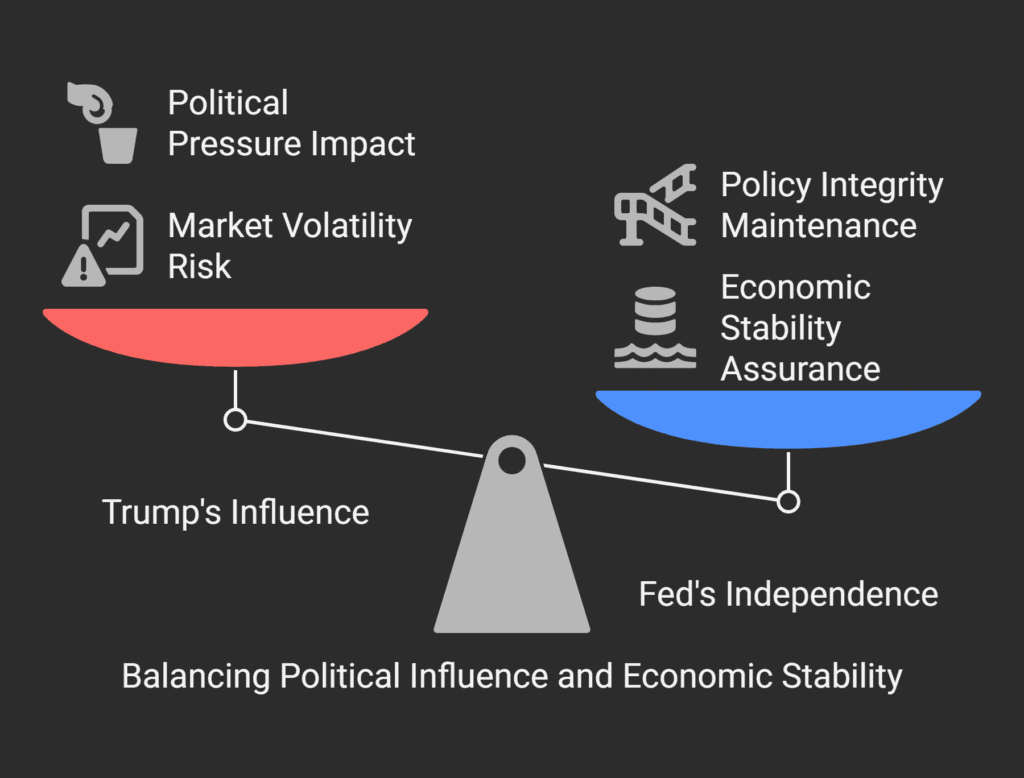

Let’s rewind. Donald Trump has never been shy about criticizing the Fed. During his presidency, he called Powell an “enemy” of America for raising interest rates too quickly. Now, with Trump positioning himself for a 2024 comeback, the rhetoric is heating up again. Last week, he accused Powell of “purposely tanking the economy” to hurt his election chances, according to a Reuters report.

Why does this matter? The Fed’s independence is sacrosanct in economic policy. When a political heavyweight like Trump openly undermines its chair, it rattles investor confidence. Suddenly, markets worry that the Fed might bend to political pressure—either keeping rates too low (fueling inflation) or hiking them recklessly (triggering a recession). Gold, sensing the chaos, becomes everyone’s favorite insurance policy.

How Today’s Gold Price Compares to Past Highs

Let’s break this down with a quick comparison. Below is a table showing gold’s price milestones alongside the events that drove them:

| Year | Gold Price (Peak) | Key Drivers |

|---|---|---|

| 1980 | $850 | Oil crises, hyperinflation fears |

| 2011 | $1,920 | Post-2008 recovery doubts, Eurozone debt crisis |

| 2020 | $2,075 | COVID-19 pandemic, global lockdowns |

| 2024 | $3,500 | Trump-Powell feud, inflation, geopolitical risks |

What stands out? Today’s surge isn’t just about one factor. It’s a cocktail of political instability, stubborn inflation (the CPI rose 3.5% last month, per CNBC), and wars in Ukraine and the Middle East. But Trump’s verbal grenades have amplified the fear.

The Ripple Effects: What This Means for You

So, you’re not a Wall Street trader. Why should you care? Let’s connect the dots:

- Your Savings: If inflation stays high, cash loses value faster. Gold acts as a hedge.

- Investments: Stocks and bonds could wobble if the Fed’s credibility erodes. Diversifying with gold might cushion your portfolio.

- The Dollar: A weaker dollar (often a result of political chaos) makes gold cheaper for foreign buyers, driving prices up further.

But here’s the twist: gold’s rally isn’t universally loved. Some analysts, like those at Goldman Sachs, argue that prices could correct sharply if the Fed regains control. Others, like hedge fund guru Ray Dalio, insist gold will hit $5,000 within a decade.

Navigating the Chaos: Smart Moves for Uncertain Times

I’m not here to tell you to buy gold. But I will say this: understand the game. When leaders like Trump turn the Fed into a political football, markets get volatile. Here’s how to stay ahead:

- Stay Informed: Follow Fed announcements and election polls. Even rumors move markets.

- Diversify: Don’t put all your eggs in one asset basket.

- Think Long-Term: Gold’s 2024 spike might be dramatic, but its real value is in stability over decades.

The Bottom Line

The gold price hitting $3,500 is more than a number—it’s a story about fear, power, and the fragile trust in our financial systems. Whether Trump’s words are bluster or a prophecy, one thing’s clear: in a world where tweets can move markets, gold’s ancient allure feels more relevant than ever.

So, keep watching. Keep asking questions. And maybe, just maybe, consider whether that shiny metal deserves a spot in your portfolio. After all, as the saying goes: “Gold is the money of kings; silver is the money of gentlemen; barter is the money of peasants; but debt is the money of slaves.”

People also ask

Why did gold prices hit a record high on Tuesday?

Gold prices hit a record high on Tuesday due to growing geopolitical tensions, ongoing inflation concerns, and expectations of interest rate cuts by the Federal Reserve. These factors have pushed investors toward safer assets like gold. A weaker U.S. dollar also contributed to the surge.

Will gold hit $4,000 an ounce next year?

While some analysts believe gold could reach $4,000 an ounce in 2026, it’s highly speculative. If inflation persists, central banks continue buying gold, and global tensions rise, such a milestone could be possible. However, much depends on interest rates and economic stability.

Why did gold rise above $3,500 an ounce?

Gold surpassed $3,500 an ounce due to increased investor demand, central bank purchases, and a weakening dollar. Uncertainty in global markets and the anticipation of rate cuts have made gold more attractive as a hedge against economic instability.

Why has gold surged a third in 2025?

Gold has surged over 30% in 2025 driven by economic uncertainty, central banks accumulating gold reserves, and expectations of monetary easing. Investors are seeking safe havens amid market volatility and global conflicts, pushing demand—and prices—higher.

Did investors invest $19bn in gold in the first quarter?

Yes, investors poured around $19 billion into gold in the first quarter of 2025. This reflects growing interest in gold as a safe-haven asset amid economic and geopolitical uncertainty. Gold ETFs and futures saw significant inflows.

What’s going on with US gold futures?

U.S. gold futures are surging amid speculation of interest rate cuts and strong demand from institutional investors. The rally reflects both inflation hedging and a move toward safer assets. Futures markets are showing bullish sentiment with record volumes.

💸 Invest at your own risk.

📊 Past performance does not guarantee future results.

📜 Always do your own research or consult a licensed financial advisor.