You know how the stock market can feel like a rollercoaster? Well, it’s been a wild ride lately, with Dow Jones futures dipping, Tesla’s stock skidding, and buzz about potential changes to EV policies under Trump. Don’t worry if you’re not a market expert—I’m here to break it all down in a way that makes sense. Let’s chat about what’s happening and why it matters.

What’s Going On with Dow Jones Futures?

First, let’s talk about Dow Jones futures. These are contracts that speculate on the future value of the Dow Jones Industrial Average, which tracks 30 major U.S. companies. Think of them as the stock market’s crystal ball, predicting how things might look tomorrow.

Recently, Dow Jones futures took a dip, and it wasn’t just them—the S&P 500 and Nasdaq futures also slid. The market’s mood has been cautious, especially after Federal Reserve Chair Jerome Powell made comments hinting there’s no rush to cut interest rates.

Why does this matter? Interest rates affect everything, from how much it costs companies to borrow money to how much you and I might pay on our mortgages. Powell’s message basically said, “Don’t expect lower rates anytime soon,” which can make investors nervous.

Tesla’s Stock Takes a Hit

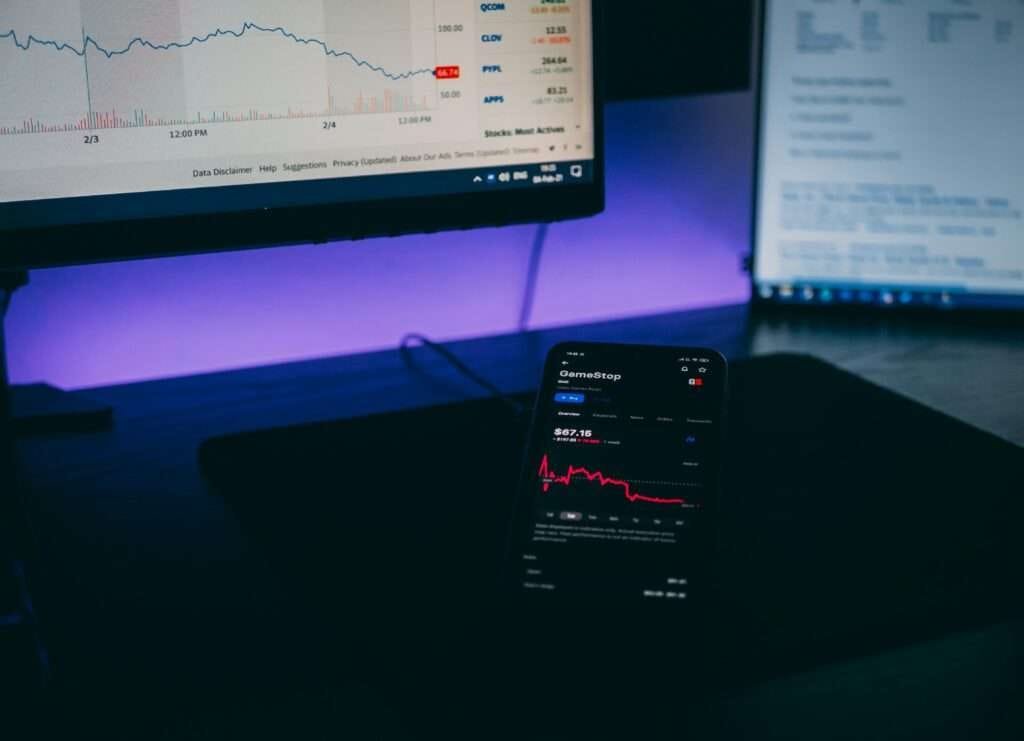

Now, let’s zoom in on Tesla. If you’re a Tesla fan—or just someone keeping an eye on the EV space—you’ve probably noticed the stock dropped about 5.8% recently.

What’s behind this? It’s linked to the possibility that Trump could cut the $7,500 federal tax credit for electric vehicles. This credit has been a game-changer, making EVs more affordable for a lot of people. Without it, the cost of buying a Tesla—or any electric car—might feel like a big leap for many.

Think about it: If you were considering an EV and suddenly found out you wouldn’t get that tax break, would you hesitate? Many people might, and that’s why Tesla’s stock is feeling the pressure.

Trump’s EV Policy Shake-Up

Speaking of Trump, his potential changes to EV policies are making waves. During his campaign, he was pretty vocal about wanting to cut incentives for electric vehicles. Now, as President-elect, those ideas might become reality.

Why would he do this? Trump’s focus has often been on boosting traditional energy sectors like oil and gas. Cutting EV incentives could align with that goal, even though it might slow down the shift to cleaner, greener transportation.

For companies like Tesla, Rivian, and even legacy automakers dipping into EVs, this kind of policy change could be a big deal. Investors are already bracing for what it might mean, which is part of why Tesla’s stock isn’t looking so hot right now.

Palantir’s Big Move to Nasdaq

Amid all this, Palantir Technologies has been making its own headlines. The company recently moved its stock listing to the Nasdaq, leaving the New York Stock Exchange behind. Why does this matter?

Well, being listed on Nasdaq could mean Palantir gets added to the Nasdaq 100, a prestigious index that includes tech giants like Apple and Microsoft. It’s like moving to the cool kids’ table in the cafeteria.

For Palantir, this move might attract more investors and boost its visibility. If you’re someone who likes keeping an eye on tech stocks, this could be a story worth following.

What Does This Mean for Us?

Okay, so what does all this mean for you and me? Let’s break it down.

1. Stay Calm

First off, don’t panic. The stock market is always going to have its ups and downs. Just because Dow Jones futures are down today doesn’t mean we’re headed for a financial apocalypse.

2. Keep an Eye on EV Trends

If you’re interested in electric vehicles—whether as a consumer or an investor—this is a good time to stay informed. Will Trump’s potential policy changes slow down EV adoption? Or will companies find ways to adapt and keep pushing forward?

3. Review Your Investments

If you’ve got money in the stock market, now’s a great time to check your portfolio. Are you too heavily invested in any one area, like tech or energy? Diversifying can help protect you from market swings like this.

4. Think Long-Term

Remember, investing isn’t about chasing quick wins—it’s about building wealth over time. Even if Tesla’s stock is down now, that doesn’t mean it won’t bounce back. The same goes for the broader market.

What’s Next?

As we watch these stories unfold, there are a few things to keep an eye on. For one, how will Tesla respond to the potential loss of the EV tax credit? The company has a knack for innovation, so don’t count them out just yet.

Also, what will Trump’s actual policies look like once he takes office? Campaign promises don’t always turn into reality, so it’s possible some of these changes won’t happen—or won’t happen the way we expect.

And finally, how will the broader market react to these shifts? Whether it’s Dow Jones futures, tech stocks like Palantir, or the EV market, there’s a lot to watch in the months ahead.